Monday 1 September 2014

Tuesday 27 October 2009

FNDLOAD for user-defined tables..

pyusertable.lct is the lct for User Defined tables.

It handles all the four tables related to user Defined table

PAY_USER_TABLES

PAY_USER_ROWS_F

PAY_USER_COLUMNS

PAY_USER_COLUMN_INSTANCES_F

Cheers

Ganesh

It handles all the four tables related to user Defined table

PAY_USER_TABLES

PAY_USER_ROWS_F

PAY_USER_COLUMNS

PAY_USER_COLUMN_INSTANCES_F

Cheers

Ganesh

Labels:

FNDLOAD User defined tables

Friday 7 August 2009

SYSDATE or TRUNC(SYSDATE)?

One of the common mistakes non-HRMS developers make when they start with HRMS is to use sysdate instead of trunc(sysdate).

While the procurement, financials and the other modules use the time component heavily, HRMS does not capture the time component.

Take an employee record with the following data..

Effective Start Date: 01-Jan-2009 and Effective End Date: 07-Aug-2009.

On the 7th of August, If we run a query like this, we will expect this employee to be present.

select *

from per_all_people_f

where sysdate between effective_start_date and effective_end_date

But this employee wont be in the results.

Because, as sysdate(lets say '07-Aug-2009 12:34:56') will be compared against '07-Aug-2009 00:00:00' and the employee will be left.

Cheers,

Ganesh

While the procurement, financials and the other modules use the time component heavily, HRMS does not capture the time component.

Take an employee record with the following data..

Effective Start Date: 01-Jan-2009 and Effective End Date: 07-Aug-2009.

On the 7th of August, If we run a query like this, we will expect this employee to be present.

select *

from per_all_people_f

where sysdate between effective_start_date and effective_end_date

But this employee wont be in the results.

Because, as sysdate(lets say '07-Aug-2009 12:34:56') will be compared against '07-Aug-2009 00:00:00' and the employee will be left.

Cheers,

Ganesh

Labels:

oracle hrms trunc sysdate

Wednesday 22 April 2009

New metalink note for GSP(Grade Step Progression)

There is a new note about GSP published in metalink yesterday.

Note Id: 794442.1 - Grade Step Progression (GSP) Focus Area

Cheers

Ganesh

Note Id: 794442.1 - Grade Step Progression (GSP) Focus Area

Cheers

Ganesh

Labels:

grade step progression,

grades,

gsp

Tuesday 7 April 2009

Workflow Status Monitor error..

After upgrade to 11.5.10.2 we had issues with the Workflow Status Monitor Diagram.

We need to set the following profile values at the site level to fix this..

1. Server Timezone

2. Client Timezone

To be on the safer side, give them the same value.

Cheers,

Ganesh

We need to set the following profile values at the site level to fix this..

1. Server Timezone

2. Client Timezone

To be on the safer side, give them the same value.

Cheers,

Ganesh

Tuesday 30 September 2008

Incorrect Tax Code in P45 Output..

What happened?

After applying the HR Family Pack K-RUP3 , the P45 is showing incorrect tax code.

How do we fix it?

Oracle has released couple of patches for this issue. One for 11i and a forward port for R12.

7410767-P45 SHOWING WRONG TAX CODE AFTER APPLYING SEPTEMBER 08 PATCH 7246613

7420661-HRMSR12: FWD PORT OF 7410767

Cheers,

Ganesh

After applying the HR Family Pack K-RUP3 , the P45 is showing incorrect tax code.

How do we fix it?

Oracle has released couple of patches for this issue. One for 11i and a forward port for R12.

7410767-P45 SHOWING WRONG TAX CODE AFTER APPLYING SEPTEMBER 08 PATCH 7246613

7420661-HRMSR12: FWD PORT OF 7410767

Cheers,

Ganesh

Thursday 25 September 2008

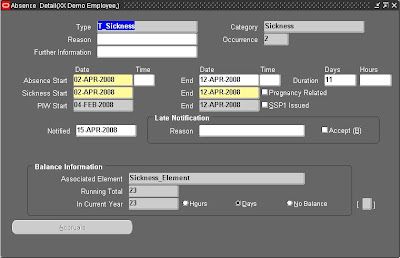

Statutory Sick Pay(SSP)

What is SSP?

SSP stands for Statutory Sick Pay.

Why should an employer pay this to employees?

According to UK legislation, provided an employee satisfies certain conditions, whenever he takes certain types of leaves, the employer has to pay him the SSP.

What are all the Steps involved?

1.Defining the Time Unit

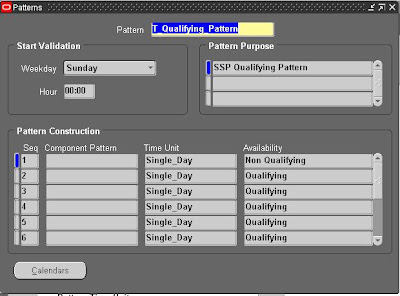

2.Defining the Qualifying Pattern

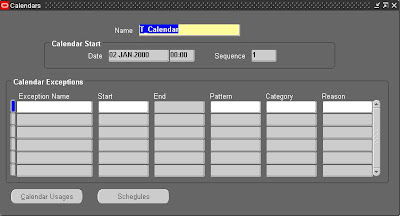

3.Defining the calendar

4.Assign the calendar to the Business Group or to a particular employee.

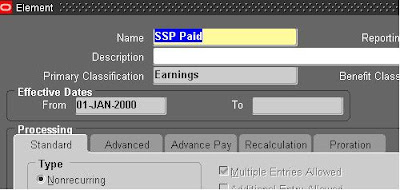

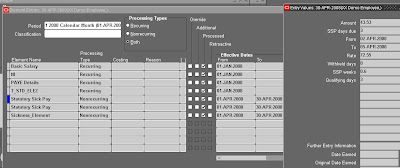

5.Define the elements and element links

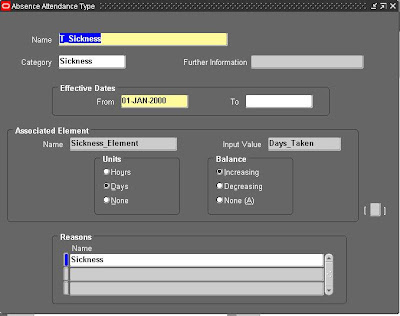

6.Define the Absence Types

7.Enter the absences for employees

8.This creates the corresponding element entries

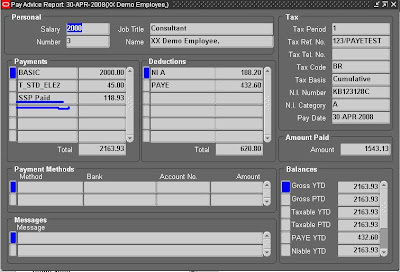

9.Run the quick pay and make sure that the employee is paid the SSP accordingly.

We will see all these steps in detail below

1. Time Unit & Qualifying pattern: To understand this, we need to understand the Qualifying pattern first.

If an employee is on leave on Monday and if he is Sick, then we have to pay SSP. But if is sick on a Sunday there is no requirement to pay SSP. So the weekdays will be Qualifying days while weekends will be non-qualifying days. The time unit acts as a component for the same.

3.Defining the calendar

Here we are defining the date range in which the Qualifying pattern is valid

4.Assign the calendar to the Business Group or to a particular employee.

We have to attach the calendar to the Business Group itself or to an employee alone.

5.Define the elements and element links

There are two elements provided by Oracle for SSP. "Statutory Sick Pay" and "SSP Corrections". But they are non-payments. So we have to define our own Earnings element and pass the seeded element's run result value to our element using Fast Formula.

6.Define the Absence Types

7.Enter the absences for employees

8.This creates the corresponding element entries

9. Run the quick pay and make sure that the employee is paid the correct SSP.

SSP stands for Statutory Sick Pay.

Why should an employer pay this to employees?

According to UK legislation, provided an employee satisfies certain conditions, whenever he takes certain types of leaves, the employer has to pay him the SSP.

What are all the Steps involved?

1.Defining the Time Unit

2.Defining the Qualifying Pattern

3.Defining the calendar

4.Assign the calendar to the Business Group or to a particular employee.

5.Define the elements and element links

6.Define the Absence Types

7.Enter the absences for employees

8.This creates the corresponding element entries

9.Run the quick pay and make sure that the employee is paid the SSP accordingly.

We will see all these steps in detail below

1. Time Unit & Qualifying pattern: To understand this, we need to understand the Qualifying pattern first.

If an employee is on leave on Monday and if he is Sick, then we have to pay SSP. But if is sick on a Sunday there is no requirement to pay SSP. So the weekdays will be Qualifying days while weekends will be non-qualifying days. The time unit acts as a component for the same.

3.Defining the calendar

Here we are defining the date range in which the Qualifying pattern is valid

4.Assign the calendar to the Business Group or to a particular employee.

We have to attach the calendar to the Business Group itself or to an employee alone.

5.Define the elements and element links

There are two elements provided by Oracle for SSP. "Statutory Sick Pay" and "SSP Corrections". But they are non-payments. So we have to define our own Earnings element and pass the seeded element's run result value to our element using Fast Formula.

6.Define the Absence Types

7.Enter the absences for employees

8.This creates the corresponding element entries

9. Run the quick pay and make sure that the employee is paid the correct SSP.

Subscribe to:

Posts (Atom)